Is It Worht It To Repair A Car That'll Cost More Than The Car's Worth

9 Min Read | Aug 26, 2021

Your car has been in the shop more than in your driveway lately. And yous have another big repair on the horizon. You're sick of sinking money into it, just yous're not certain what to practise next.

Do yous keep throwing greenbacks into it and promise information technology doesn't break down again? Or do you sell it and use that coin toward another ride? It's a big determination.

The first step in solving a dilemma like this is to practice a niggling math. Don't worry! We'll walk you through information technology step by step. Your calculations will bespeak y'all in the right direction and help accept the stress out of your conclusion-making!

And the best part? After you lot decide what to do, we'll show you how to salve money for the repair or your adjacent auto. Check it out, and and so go back to your life—and all the places it takes you.

Should I Repair or Supplant My Auto?

Before nosotros go into the numbers, information technology's important to remember there's always a spectrum when it comes to car repairs. Meaning the math can only show you so much—similar whether yous're leaning more than toward a repair or replacement. Other factors, such equally repair frequency and what you lot owe on your auto, come into play as well. Keep these in mind as you're running your numbers.

Start budgeting with EveryDollar today!

Okay, time to go started. First, estimate the value of your car (without repairs). Sites like Kelley Bluish Volume or Edmunds are good examples of resources that tin can help y'all with your estimation.* Only for statement's sake, allow's say it's $5,000. And your estimated repair is $ane,000. We'll say for this example that the repair will bring the value of your motorcar up to $half dozen,000. That may non be the case in every situation, depending on the overall condition of your car and the blazon of repair. Your mechanic should be able to requite you an thought of how much value your repair will add to your car.

So in this example, if you had to sell your car immediately after the repair, you'd still recoup the money you just put into information technology. In this case, you're probably leaning more than toward a repair. Now, if this is your commuter car and you're getting to work late once a week cheers to a breakdown, it might exist fourth dimension to evaluate what these repairs are really costing you lot—in terms of headaches.

On the other hand, if that initial mechanic nib was closer to $2,000, and the value of the car increased to only $vi,000 with the repair, y'all're likely leaning toward selling the car and putting that coin toward another car with your $7,000. That way, you're essentially getting a meliorate motorcar for the same money.

Owe more on your automobile than it'due south worth? Here's what to exercise virtually your upside-downwardly car.

If You Want the Fix: 6 Steps to Pay for Car Repairs

Decided to go ahead with the repair? Your next issue is paying for it—because it'due south probably going to cost a non-so-squeamish chunk of change. But what if you don't take the cash on hand to pay the pecker? That'southward okay. Here are six steps to finding the money you need to fund your repair:

Footstep i: Shop around.

Don't accept the commencement quote you're handed. Become the initial diagnosis from a trusted dealership or a larger mechanic store, only don't assume their price is the cost. The majority of your cost is probably not parts, but labor. And it'south nearly ever college at larger, more established shops.

To find a reliable mechanic for a lower price, enquire a few friends where they go for trustworthy work. And so call around to detect the best toll. While you're on the phone, ask nearly any current discounts and specials they might offering besides.

Step 2: What can you practise yourself?

Possibly you need new brakes, but you also need to replace the door handle that came off this morning.Why not get the brakes fixed at the shop, and find an afterwards-market replacement for your door handle online? And then picket a YouTube video and set up it yourself. Just exist sure to follow the directions very carefully.

Footstep 3: What can await?

If the estimated repair is still out of your comfort zone, enquire the mechanic what needs to be stock-still now and what can wait a few months. Don't skip important safety features like brakes, tires and timing belts. But you tin can live without automatic windows for a while.

Step four: Make a budget.

Let'southward say you've lowered the repair toll every bit much as possible. Now it'southward time to find the cash to pay your bill. We recommend making a zero-based upkeep before you commencement overturning your burrow cushions in search of loose alter. You can make a upkeep in about 10 minutes with our favorite budget app, EveryDollar. It's free, and it'due south a way less labor-intensive than excavation through your sofa.

Step five: Move your money.

If you're still coming up brusk, no trouble. Only dial your budget back in nonessential areas like restaurants, haircuts and new apparel. You tin also divert your savings temporarily. And as a very concluding resort, y'all can use your emergency fund for absolutely necessary repairs. Only restock it as shortly as possible.

Step half-dozen: Budget for future repairs.

Ensure this issue doesn't happen to you again by creating a line item in your budget for hereafter machine repairs and maintenance. That way, the coin will be there waiting for you lot when you demand it—and you volition.

If You Want a Replacement: Should Y'all Lease, Buy New, or Purchase Used?

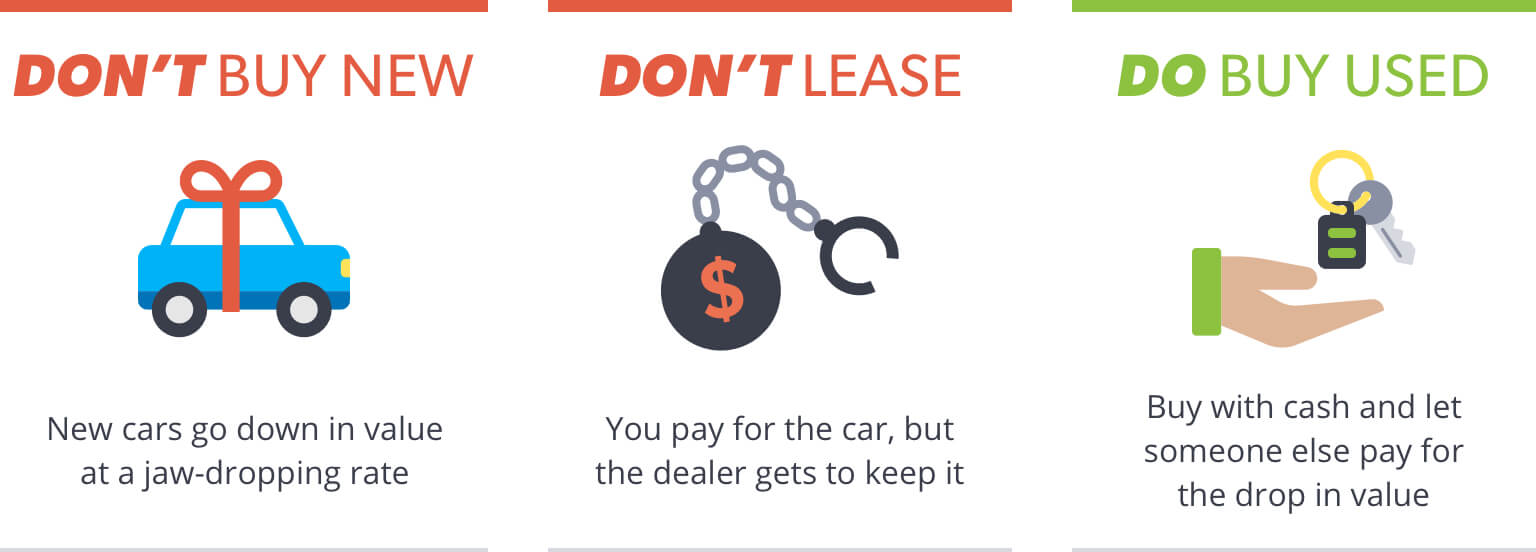

Permit'southward say you've decided information technology's not worth it to repair your current auto. You're set up for something else. While it'south tempting to desire your next car to be new and under warranty (read: no repairs!), the terminal thing you desire to do is caput to the nearest new car dealership. Hither'due south why:

New Cars.

The depreciation on a new vehicle is jaw-dropping. A $20,000 machine will be worth nearly $8,000 in v years.[1] That's a 60% subtract! Even subsequently just i year, the auto could become down in value as much as 25%. So unless you accept a net worth over $one meg, don't buy new—e'er. Permit someone else absorb the depreciation.

Leased Cars.

A lease is simply the most expensive way to operate a car. Every month, your lease payment goes to comprehend the car'southward depreciation plus the dealer's profit. At the end of the lease, y'all have zero equity in the automobile, but you do have the option to buy it. That may or may not be a good deal since the purchase price is set at the beginning of the lease and isn't based on the actual value of the car at the stop of the lease. Then there are the fees—a fee y'all'll pay if you exceed a certain number of miles or have excessive wear and tear on the car, a fee you'll pay if y'all decide not to buy the car when your lease is upwardly, and a fee you'll pay if you do decide to purchase it. All that adds up to a good deal for the dealer—non for you.

Used Cars.

Your best bet is to purchase an affordable, used motorcar with the coin you have saved (combined with the cash from the sale of your current auto). That way you lot ain the auto, rather than it owning you. Used motorcar doesn't mean crap motorcar; it just means you're smart plenty to permit someone else pay for that initial drop in value. Ownership used is the only way to go.

Detect out how to get the best deal on a car you honey! Download our free Car Guide today!

How to Pay for a Automobile in Cash

Don't go into debt for a car. It's just not worth it. That will only give you more grief down the road. Remember, all cars need repairs and maintenance somewhen. With a loan, you'll take a monthly automobile payment and repair bills on summit of that.

Don't become into debt for a car. It's just non worth information technology.

So how exactly do y'all alive without a car payment and still become the car of your dreams? The key is in your approach to saving money. Hither'due south a strategy we beloved:

1. Salve Your Car Payment.

Go ahead and buy the car y'all tin afford with the cash y'all have on hand—let's say it's $5,000. That can become you effectually for at to the lowest degree ten months or so. Then have $500—the average monthly payment on a new car—and salvage it every month.[2]

ii. Sell Your Car and Combine Your Savings.

Later ten months of doing that, you'll have congenital your car-buying budget support to $5,000. Add that to the greenbacks you get from the auction of your electric current car (let's say $four,000), and you have $9,000 for a new ride. That's a major upgrade in motorcar in only 10 months—without owing the depository financial institution a dime!

three. Keep Saving and Upgrading.

But the fun doesn't have to stop there. If y'all keep consistently putting the same corporeality of coin away, 10 months later you'll have another $5,000 to put toward a motorcar. You could probably sell that $ix,000 vehicle for a little less than y'all paid 10 months earlier—meaning you'd likely have around $13,000 to pay for a car, just 20 months afterward this whole procedure started.

The bottom line is this: There's a lot y'all could do with an extra $500 a month!

The less money you're spending on your car, the more money you have to put toward more important things, similar your kids' college fund, your retirement, and paying dorsum those old student loans. It's okay to own a nice car—but don't let your car own y'all.

In fact, don't let whatsoever of your stuff—or even your money—own you lot. You're the i in charge hither! Aye—y'all. If you want to learn how to take control of your coin for good, give Ramsey+ a test-bulldoze. You'll go all the tools and all the teachings you need to make your money piece of work for you, instead of the other manner around. And right now, yous can try Ramsey+ in a free trial. Nail.

*Kelley Blue Volume and Edmunds are not in any way affiliated with the publisher of this content. The site links provided are for reference only and non an endorsement of any production or service. No warranty or representation is made regarding these third political party sites or services.

About the author

Ramsey Solutions

Source: https://www.ramseysolutions.com/budgeting/should-i-repair-or-replace-my-car

Posted by: blakelivelyins.blogspot.com

0 Response to "Is It Worht It To Repair A Car That'll Cost More Than The Car's Worth"

Post a Comment